UPI :Unified Payments Interface

UPI is controlled and regulated by NPCI(National Payment Corporation of India).UPI launched on 11th April 2016 by the Reserve Bank of India Governor Dr.Raghuram G Rajan at Mumbai with the aim of Cashless India.

How to Use UPI service?

Any UPI client app may be used and multiple bank accounts may be linked to single app. Official UPI app launched by NPCI is BHIM or Bharath Interface for Money.Anyone with a bank account + registered mobile number + debit card can use BHIM app.How to transact using BHIM?

Step1:Download and install the App from Paystore or iOS app store.Step2:Select the mobile number linked to your bank account, in case you are using a dual SIM phone

Step 3:Enter your bank Account

Up on selecting SIM an SMS will be send to verify your mobile number. After verification you will be asked to enter your bank account number.

Step3:After validating your bank account and mobile number you will be asked to set a four digit Passcode.

Confirm your Passcode and proceed.

Step3:After validating your bank account and mobile number you will be asked to set a four digit Passcode.

Confirm your Passcode and proceed.

Step5:Select bank account enter and enter last six digit of your ATM/Debit card and validity

Step6:After validating ATM/Debit card details and OTP will be received .Enter OTP and set 4 digit UPI PIN.

Now app is ready to use.

Apart from BHIM UPI app almost all banks operating in India have their own mobile banking application with UPI integration.

Paytm was founded in 2010 by Vijay Shekhar as didgital wallet. After the introduction of UPI they have integrated all UPI services in their existing app.

Step6:After validating ATM/Debit card details and OTP will be received .Enter OTP and set 4 digit UPI PIN.

Now app is ready to use.

STEPS to use UPI through USSD service *99#

It is not necessary to have an internet enabled smart phone to use avail UPI services. You can transact using UPI through USSD service.Apart from BHIM UPI app almost all banks operating in India have their own mobile banking application with UPI integration.

Performing a UPI Transaction:Sending money using virtual address

- User logs in to UPI application

- After successful login, user selects the option of Send Money/Payment

- User enters beneficiary’s/Payee virtual id, amount and selects account to be debited

- User gets confirmation screen to review the payment details and clicks on Confirm

- User now enters UPI PIN

- User gets successful or failure message

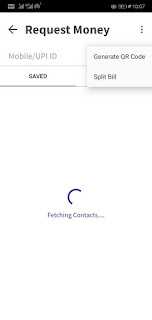

Requesting money:

- User logs in to his bank’s UPI application

- After successful login, user selects the option of collect money (request for payment)

- User enters remitters/payers virtual id, amount and account to be credited

- User gets confirmation screen to review the payment details and clicks on confirm

- The payer will get the notification on his mobile for request money

- Payer now clicks on the notification and opens his banks UPI app where he reviews payment request

- Payer then decides to click on accept or decline

- In case of accept payment, payer will enter UPI PINto authorize the transaction

- Transaction complete, payer gets successful or decline transaction notification

- Payee/requester gets notification and SMS from bank for credit of his bank account

Other Popular UPI app

1. PaytmPaytm was founded in 2010 by Vijay Shekhar as didgital wallet. After the introduction of UPI they have integrated all UPI services in their existing app.

2.Google pay(formerlyTez)

Google pay is a system developed by Google to power in-app and tap-to-pay purchases on mobile devices, enabling users to make payments with Android phones, tablets or watches.You can use Google pay as a digital wallet as well as a UPI app.Google pay is one of the most popular UPI app in India

Google pay is a system developed by Google to power in-app and tap-to-pay purchases on mobile devices, enabling users to make payments with Android phones, tablets or watches.You can use Google pay as a digital wallet as well as a UPI app.Google pay is one of the most popular UPI app in India

3.Phonepe

PhonePe is a financial technology company headquartered in Bangalore, India. It was founded in December 2015. It provides an online payment system based on Unified Payments Interface (UPI).Phonepe app is also a popular UPI app after googlepay.

BHIM QR payment system

Almost all UPI apps now support QR code based payments system. in QR code payment you need to scan a QR code instead of entering recipient VPA.

Once you install the app and register yourselves , you can generate two types of QR Codes:

- A dynamic one-time unique QR Code for a fixed amount

- A static code for any amount

A dynamic one-time unique QR Code for a fixed amount:You can generate a dynamic QR code for receiving a certain amount from a person.You have to opt for request money.

Under request money you will get 'Generate QR code' option as shown below. Payment request can be directly send by entering UPI ID of payer or else you can generate QR code.

Enter amount and press generate QR code

You can share QR code with the payer or he/she can directly scan the QR code from his/her UPI app and make the payment instantly.

For getting static QR code go to your profile. There you can download/share your QR code. This can be used for receiving any amount.

As government of India is focusing on cashless economy , BHIM and UPI is expected to gain wide popularity among its citizens.

No comments:

Write comments